The company did not itemise the test feesas a separate entry on its sales invoices. An example of disbursement would be a solicitor paying the stamp duty land tax (SDLT) on behalf of his client. This is clearly a client’s expense, as SDLT is the buyer’s responsibility not the solicitor’s. Visit Treasury Insights for information on cash positioning and forecasting, fraud protection, managing payments, and more. Equipped with your account totals, you can fund your Wells Fargo account with the amount necessary to cover daily disbursements.

Federal Disbursement Services (FDS)

A money lender can either agree to give you the funds requested or decline to lend you the money. When your loan application gets approval, the lender needs to find a way to transfer the money to you. Loan disbursement is the process of moving cash from the lender’s account to your account.The lender will then disburse the funds depending on the type of loan. Personal loans are typically directly deposited to the borrower’s checking account, while student loans may go directly to the school to pay for fees and tuition. When you apply for a mortgage loan, the funds are usually paid directly to the seller.It is essential that you ask your lender how they will disburse the funds.

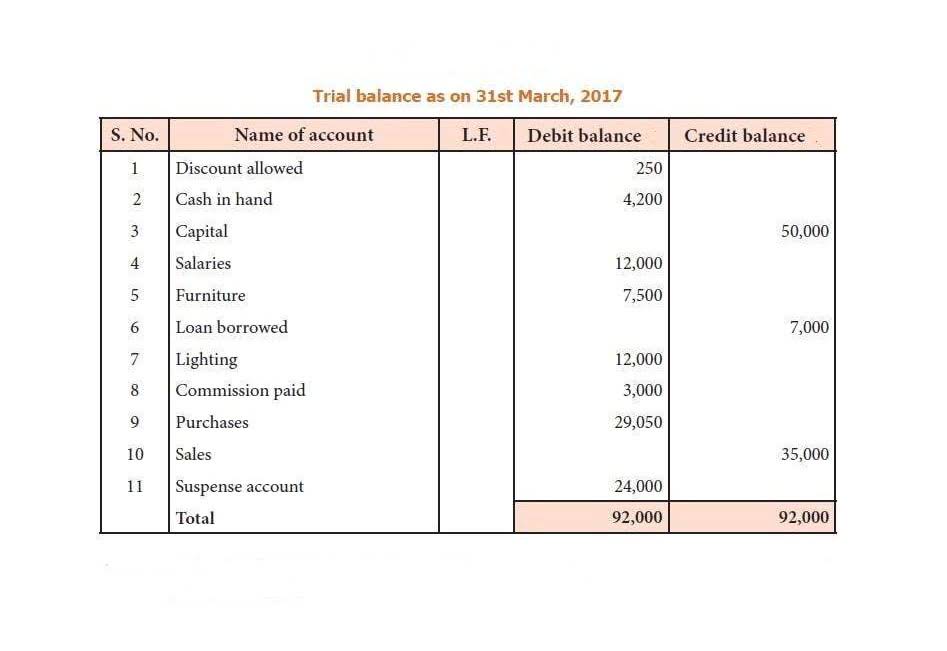

- All debit entries are recorded in the other accounts or accounts payable columns.

- But, if you’re just looking to get a better understanding of a controlled disbursement account, keep reading.

- A disbursement fee is usually a charge to cover payments made by the vendor on behalf of a customer.

- It aids in effortless expense tracking and reconciliation while acting as a valuable reference for financial reporting, budgetary assessments, and audit reviews.

- However, they can offer value for smaller and medium size businesses as well.

- The overall cash balance of the business is adjusted to account for the disbursement.

- Delayed disbursement is a deliberate financial strategy used by organizations to handle finances effectively, manage cash flow, and negotiate favorable terms.

The impact of disbursements

Reimbursement occurs after an individual or entity has made payments or managed expenses, reimbursing them for those costs. While these payments often relate to expenses, the term encompasses a broader range of financial activities involving fund release, distribution, or transfer. Disbursal fees can differ based on the institution, account type, or transaction nature. They are generally outlined upfront in the terms and conditions or agreements pertinent to the specific financial arrangement. An example of reimbursement would be the cost of travel, stationery or other ‘out of pocket expenses’ added by a consultant on top of his ‘hourly consultancy fee charge’.

- Loan proceeds shall be disbursed through PESONet participating banks only.

- A disbursement is an act of paying out money – especially from a public or dedicated fund.

- This typically means segregating duties where possible, with separate people in charge of approving and scheduling the disbursements.

- You will receive a confirmation message from the list in 15 minutes – reply to the message.

- These payouts are made in several ways, including checks and electronic funds transfers.

AccountingTools

The cash disbursement journal is posted to the general ledger every month. This practice originated in the days when banks could only process a payment after receiving the physical check, which could delay the debit to a payer’s account for up to five business days. However, the widespread use of electronic checks has made this technique less practical. A cash disbursement report can help you keep track of cash-based spending during the year to better manage your company’s cash flow. Disbursements are paid in cash or an equivalent method by your company during a specific period of time, like a quarter or a year. If you use the accrual method of accounting, you would report your disbursements when they occur, not when they are paid.

- Disbursement, in essence, involves allocating and transferring funds for specific purposes or obligations, constituting a pivotal step in financial transactions.

- A cash disbursement is the outflow of cash from a company to settle obligations such as AR, operating expenses, interest expenses, and more.

- Selecting this button generates an e-mail message with everything filled in — just send the message.

- For CASH Card, please ensure that the issuing bank allows the use of the same for SSS disbursement.

- This was a partial victory for the company, as it was found that the only taxable element of the supply in relation to the MOT tests was the element which exceeded the amount actually paid.

Using an automated accounts payable system like BILL makes it easier for your AP team to verify the legitimacy of invoices with two-way matching and time vendor payments for better cash flow management. All businesses make cash disbursements, but they don’t all manage them strategically for optimal liquidity and cash flows. With the proper disbursement office disbursement account solution, you can pay your beneficiaries faster and more securely. On top of that, your finance organization can save time and money like never before.Are you ready to unlock the potential of digital disbursements? Errors in the details of your enrolled disbursement account shall result to non-crediting of your benefit proceeds.

Controlled Disbursement Explained

Companies must find a delicate balance between strategically timing payments to ensure they have sufficient cash on hand while still meeting the due date. Disbursement fraud can also occur when an unrecognized company sends an invoice for goods or services never delivered, the proper approvals are not in place, and a disbursement is made. However, a disbursement example where it’s also an expense is when they’re used to support operating activities like paying rent on a warehouse space or purchasing office supplies. Continue reading below to learn more about the meaning of disbursements, how they’re used in business and their impact on financial operations for small and medium-sized companies. Disbursement is allocating or releasing funds from a designated source or account aimed at a specific purpose or recipient.

- Although disbursements are commonly found in business spending, there are other forms of disbursement in escrow, education, and special funds.

- Corporations tend to prefer controlled disbursement because of the advantages it provides in terms of interest earned.

- Individuals can choose to pay through a disbursement direct deposit if they do not want to issue a physical check or pay for goods or services in cash.

- So for example, you are planning to use your spouse Gcash account as your disbursement account, make sure that he hasn’t used it as his SSS Disbursement account.

- A money lender may fail to approve a loan or delay disbursement until the student meets the requirements.

- But, knowing how to properly time and manage disbursements can be a hurdle for small teams.

- Disbursements represent the delivery of money from a fund or account to another.

How Is a Disbursement Different From a Reimbursement?

Examples of Disbursals